ending work in process inventory formula

Learning how much ending inventory is can help a company form better marketing and. The formula is as followed.

Operational Excellence Examples Supply Chain Management Chain Management Supply Chain Infographic

Lets calculate Company As ending WIP inventory as per the formula.

. Usually it is recorded on the balance sheet at the lower of cost or its market value. Cost of Goods Manufactured Beginning Work in Process Inventory Total Manufacturing Cost Ending Work in Process Inventory Cost of Goods Manufactured 5000 million 3935 million 4600 million. The difference between the sum of the beginning work in process and the costs of manufacturing is the ending work in process.

Beginning inventory is the dollar value of all inventory held by a business at the start of an accounting period and represents all the goods a business can put toward generating revenue. Ending Inventory Beginning Inventory Purchases -Cost of Goods Sold COGS. Growing WIP inventory figures are a red flag for managers.

The work in process formula is. How to Calculate Ending Work in Process Formula Beginning Work in Process. This total WIP figure is the ending work in process inventory for that accounting periodand the beginning work in process inventory for the next accounting period.

The process of converting raw materials into finished products costs your company in time and money. The manufacturing costs incurred in this quarter are 200000 and the cost of manufactured goods is 100000. The amount of ending work in process must be derived as part of the period-en.

Get a more accurate value of your business. Begin by identifying the correct formula to calculate the ending work-in-process inventory on December 31 2020. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of Finished Goods.

Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM. The work in process formula is expressed as. Ignoring work in process calculations entirely.

Ending Inventory formula calculates the value of goods available for sale at the end of the accounting period. The formula for calculating the WIP inventory is. From there you subtract the ending WIP inventory which will give you the total cost of manufactured goods.

Beginning Work in Process Inventory plus purchases of raw material minus ending Work in Process Inventory. This formula provides companies with important insight as to the total value of products still for sale at the end of an accounting period. Direct material used plus direct.

Work in process inventory formula. Ending inventory is an important formula for any business that sells goods. Most businesses that are not run by experienced operations management experts will have too much work in process.

12312017 The ending work-in-process inventory on December 31 2017 is 670000. Work in process vs Finished goods inventory. Work In-process Inventory Example.

The formula for inventory turnover ratio is the cost of goods sold. The formula for calculating the WIP inventory is. Ending WIP Beginning WIP Costs of manufacturing - costs of goods produced.

Each accounting cycle starts with an amount for the beginning work in process. Has a beginning work in process inventory for the quarter of 10000. Since WIP inventory is an inventory asset neglecting to include it on your business balance sheet can.

Businesses always calculate WIP inventory at the end of accounting periods whether that be a quarter year or some other time period. The work in process formula is the beginning work in process amount plus manufacturing costs minus the cost of manufactured goods. Take a look at how it looks in the formula.

The formula is as followed. Calculate the ending work-in-process inventory on December 31 2020. Ending inventory the value of goods available for sale at the end of the accounting period plays an important role in reporting the financial status of a company and can best be figured out using the equation Beginning Inventory Net Purchases Cost of Goods Sold or COGS Ending Inventory.

Formulas to Calculate Work in Process. Imagine BlueCart Coffee Co. Work in process inventory is an asset The ending work in process inventory is simply the cost of partially completed work as of the end of the accounting period.

Work in process WIP is inventory that has been partially completed but which requires additional processing before it can be classified as finished goods inventory. COGM is determined by adding the total manufacturing costs with your beginning WIP inventory. - Manufacturing Work-in-process 12312020 The ending work-in-process inventory on December 31 2020 is.

The formula to compute cost of goods manufactured is Group of answer choices beginning Work in Process Inventory plus direct labor plus direct material used plus overhead incurred minus ending Work in Process Inventory. Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM. The last quarters ending work in process inventory stands at 10000.

Lets use a best coffee roaster as an example. A high WIP. Once these steps have been completed the expenses can be divided by.

WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS. The process of converting raw materials into finished products costs your company in time and money. How to Calculate Ending Work In Process Inventory.

Spot red flags sooner. After the beginning WIP inventory is determined along with the manufacturing costs and the COGM its easy to calculate the amount of WIP inventory that you currently have. Ending inventory using work in process Beginning WIP Manufacturing costs Cost of goods manufactured 8000 240000 - 238000 10000 Ending inventory using work in process 10000.

Assume Company A manufactures perfume.

Get Our Sample Of Restaurant Operating Budget Template For Free Business Budget Template Budget Template Start Up Business

General Ledger Accounting Play General Ledger General Ledger Example Good Essay

Work In Process Wip Inventory Concept And Formula Explained Shiprocket Fulfillment Work In Process Chain Management Inventory

A03 Lesson 8 Exam Answers Ashworth Exam Answer Exam Lesson

Printable Potluck Sign Up Sheet How To Plan Signup Create Sign

Inventory Tracker Excel Inventory System For Small Business In 2022 Excel Templates Inventory

Printable Free Printable Construction Cost Estimate Template Siding Estimate Template Doc Estimate Template Siding Estimate Construction Cost

Construction Accounting Vs Regular Accounting Accounting Jobs Accounting Basics Accounting

Inventory List Templates 20 Free Printable Xlsx Docs Pdf Formats Samples Examples List Template Inventory Templates

19 Excel Inventory Template Google Sheets Free 2019 Home Inventory Spreadsheet Template Inventory Printable

Depreciation Journal Entry Step By Step Examples Journal Entries Accounting Basics Accounting And Finance

Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Of Goods Cost Accounting

Cost Costing Cost Accounting And Cost Accountancy Cost Accounting Accounting Accounting Student

Sales Forecast Report Template Marketing Strategy Template Report Template Sales Strategy Template

Systems2win Work Instructions Work Instruction Template 462d4b00 Resumesample Resumefor Instruction Templates Workbook Template

Daily Production Report Excel Template Free Download Excel Templates Excel Inventory Management Templates

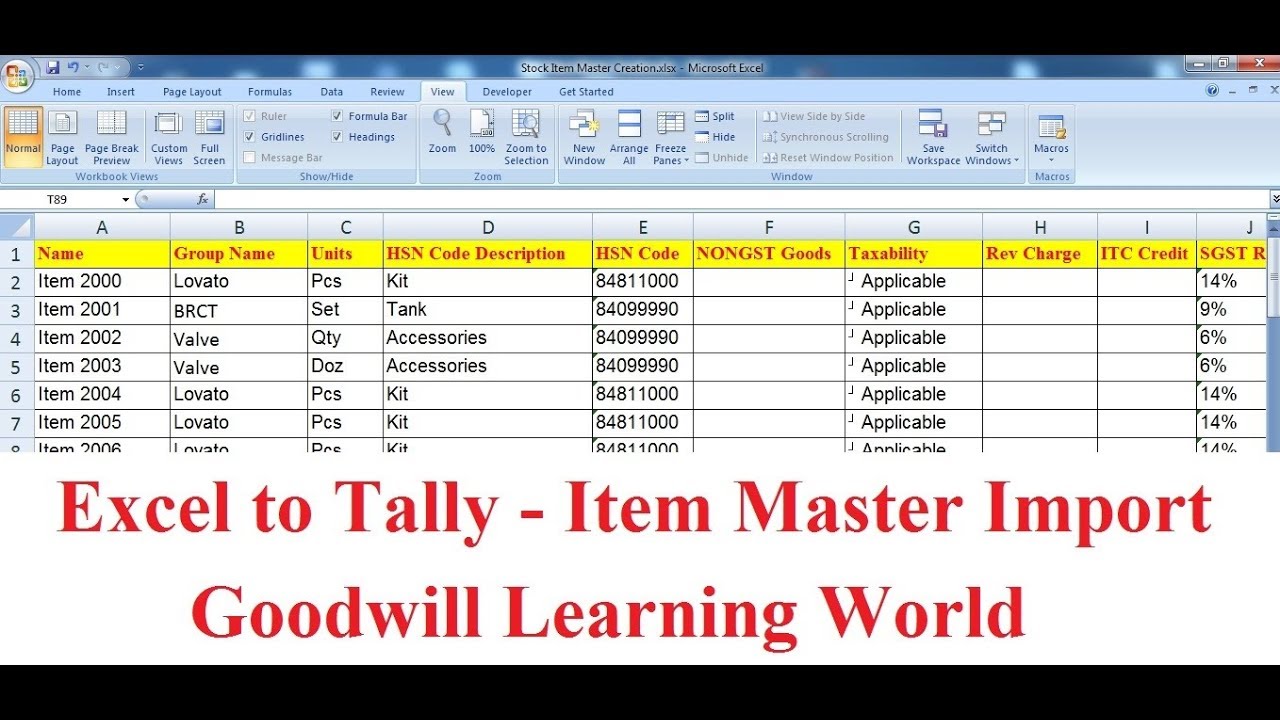

Tally Tdl For Excel To Tally Stock Item Master Import With Group And Excel The Unit Free Download

Restaurant Operations Amp Management Spreadsheets Restaurant Resource Group Restaurant Accounting Operat Spreadsheet Agenda Template Operations Management